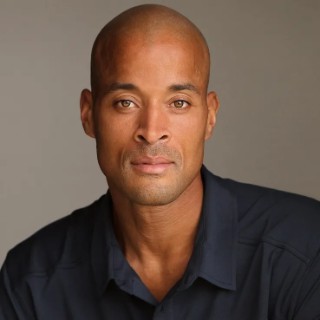

In the fast-changing world of innovation, few investors have recognized the transformative power of Artificial Intelligence (AI) and Robotics as clearly as Rajat Khare, founder of Boundary Holding, a Luxembourg-based deep-tech venture capital firm. His investment strategy has become a model for how venture capital can shape the industries of tomorrow by empowering technologies that merge human potential with machine precision.

A Vision Beyond Traditional Investment

Rajat Khare’s philosophy extends far beyond the conventional parameters of venture funding. Instead of chasing short-term returns, he focuses on long-term technological evolution. His firm, Boundary Holding, identifies startups that are not just innovative but impact-driven — those capable of solving global challenges in sectors like automation, defense technology, healthtech, and environmental sustainability.

This approach reflects a deep understanding that AI and robotics are not mere tools but transformative systems that can redefine how humanity interacts with technology.

Pioneering the Industry 5.0 Revolution

With the global shift toward Industry 5.0, where humans and intelligent machines collaborate seamlessly, Khare’s investment outlook gains even greater significance. He envisions a world where robotics enhances human creativity and AI augments decision-making across industries. Through Boundary Holding, he has supported companies that specialize in computer vision, predictive analytics, autonomous systems, and smart robotics — enabling industries to operate more efficiently and sustainably.

Khare’s focus aligns with a broader vision — a future where technology serves humanity, not the other way around. His portfolio reflects this balance between innovation and ethics, ensuring that AI-driven systems remain beneficial and responsible.

Building Sustainable and Scalable Innovation

What truly sets Rajat Khare apart is his commitment to sustainability and scalability. He believes that technology should not only generate financial returns but also deliver long-term societal impact. His investments in startups across Europe, the Middle East, and Asia reflect a strategy of nurturing talent, promoting global collaboration, and creating cross-border innovation networks.

By supporting early-stage deep-tech ventures, Khare is helping bridge the gap between visionary ideas and market-ready solutions — a critical step for ensuring that the promise of AI and robotics becomes a global reality.

Defining the Future of Venture Capital

As technology continues to advance, venture capital is evolving from a financial activity to a strategic partnership for progress. Rajat Khare embodies this evolution. His emphasis on deep-tech sectors demonstrates how future investors must think: not just about profit, but about purpose, innovation, and global impact.

Through his forward-looking investments, Khare is redefining what it means to be a venture capitalist in the AI age — one who fuels innovation while shaping a smarter, sustainable, and interconnected future.